Overview

Summerstone’s rate management solution is designed specifically for users who value:

- Self-custody: Retain full control of your funds at all times.

- Efficiency: Automated adjustments eliminate manual work, reducing stress and costs.

- Transparency: All actions and parameters are fully verifiable directly onchain.

Security and Transparency

All management parameters are locked and verifiable directly onchain, providing absolute transparency and security:

- Fixed Management Fee: A maximum fee of 0.3% annually.

- Adjustment Frequency: Normal adjustments no more frequently than once per week.

- Immutable Guarantees: Parameters enforced by smart contracts.

How the Automated Adjustment Process Works

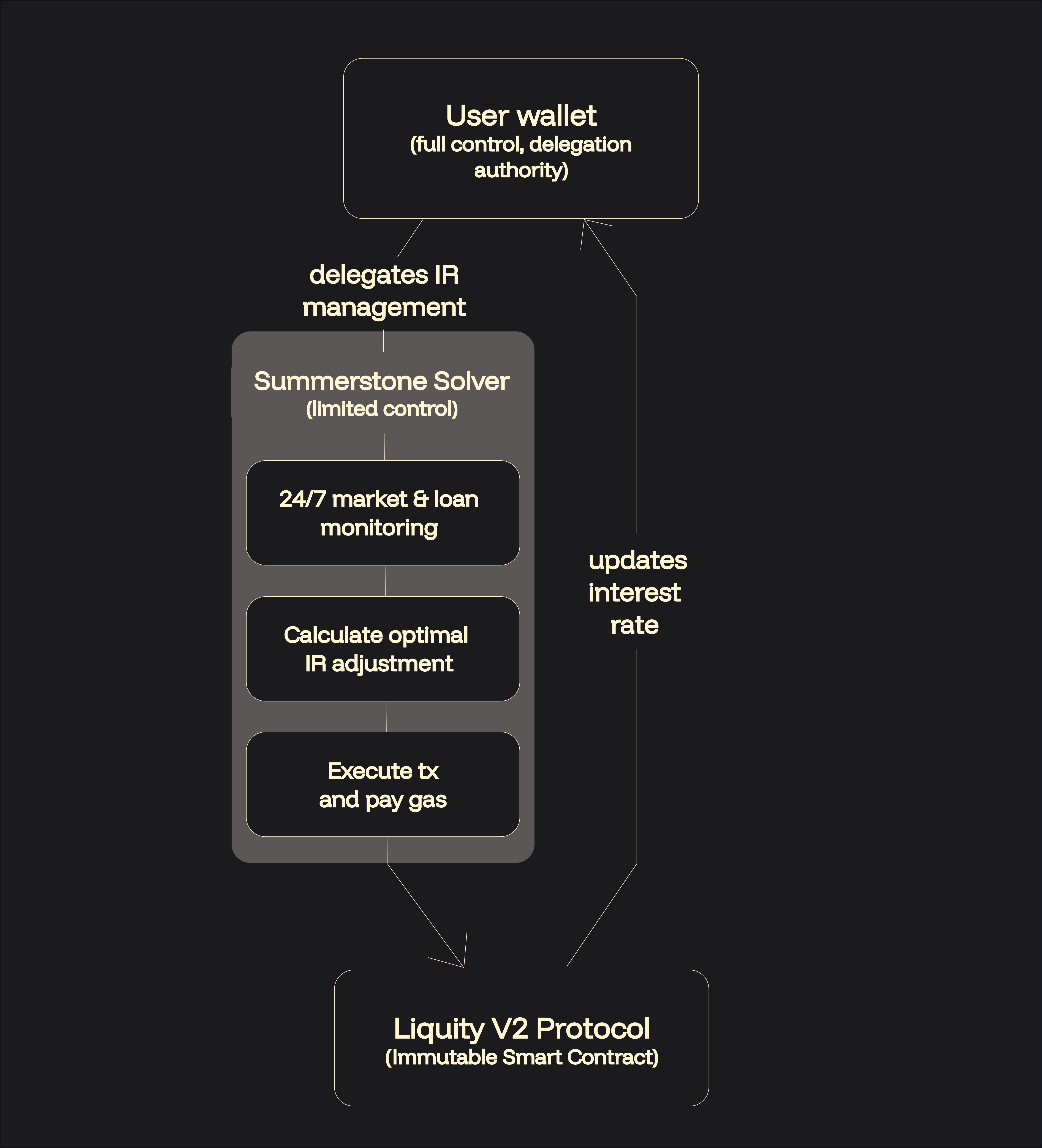

The following diagram illustrates how Summerstone’s automated interest rate management interacts with loans and the Liquity-V2-based protocols:

Explanation of the Diagram:

- Delegation: You delegate authority to adjust your loan’s interest rate (no fund custody involved).

- Monitoring: Our algorithm constantly evaluates market conditions, including debt positions, redemption risks, and gas conditions.

- Adjustment Calculation: The solver computes the optimal interest rate adjustments based on your preset risk strategy.

- Execution: Adjustments are securely executed directly on the Liquity V2 protocol, reflected transparently onchain.

Getting Started:

- Open your loan settings in a supported frontend of your chosen protocol.

- Delegate interest rate management to our verified address. Check our supported protocols.

- Confirm the transaction - your loans are now fully automated.